Welcome to the exciting world of stock options, where savvy investors can hone their trading tactics and take their returns to new heights with uncanny accuracy! If you’ve ever been bewildered by terms like Delta, Gamma, Theta, and Vega, fear not—you’re not alone.

These terms, collectively known as the “Greeks,” are actually key components that wield immense influence over option price and risk. Whether you’re a seasoned trader looking to hone your craft or a curious newcomer wanting to learn about the world of options trading, knowing these metrics is paramount to navigating this intricate world.

Join us as we unlock the mysteries of the Greeks—your trusted allies in making fully informed trading decisions—and empower you with the knowledge needed to turn market trends into profitable opportunities!

Introduction to Stock Options Trading

The world of stock options trading can be quite fascinating and complicated in nature as some take the route of receiving options trading alerts. It presents many investors with a unique opportunity, using their capital and successfully managing risk. However, jumping into this market, not fully understanding the associated intricacies, will result in costly mistakes.

Imagine having that incredible ability to forecast how changes in stock prices will impact your investments. Welcome to the Greeks, a set of metrics that serves as the trader’s navigation system for mastering the complex subtleties of option price and behavior. These indicators will not only enhance your trading strategy but also empower you to make wiser choices.

Whether you’re an advanced trader or just beginning, knowing the Greeks is an integral part of mastering stock options trading. So, let’s get into what they are and how they can help you be a better investor!

The Greeks: Delta, Gamma, Vega, Theta, and Rho

For those who are serious about trading stock options, the Greeks are essential tools. They provide important information on how different factors impact option pricing.

Delta assesses an option’s sensitivity to fluctuations in the price of the underlying asset. A higher delta indicates a more pronounced correlation with those price movements.

Gamma, in contrast, monitors the rate at which delta changes. Grasping the concept of gamma is essential for anticipating how an option’s delta will respond as market conditions evolve.

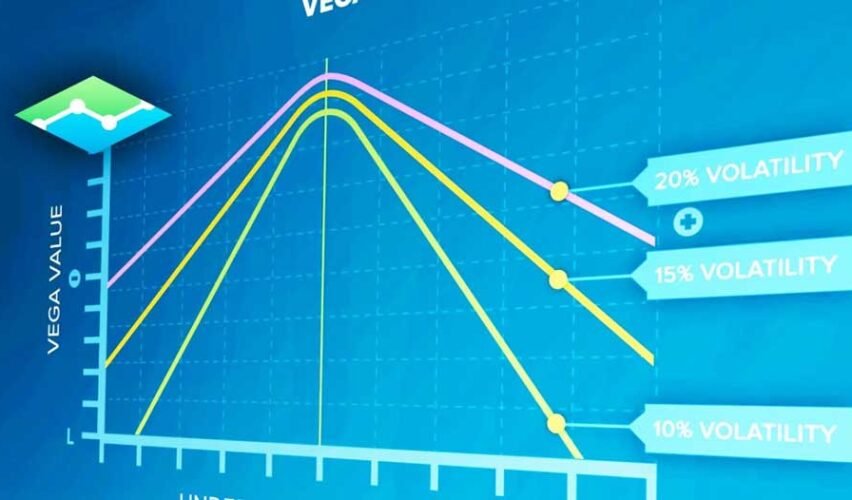

Then there’s Vega, a measure that evaluates an option’s sensitivity to volatility. If you foresee heightened market fluctuations, this aspect can profoundly influence your strategies.

Theta, on the other hand, signifies time decay, reflecting the extent to which an option diminishes in value as it nears expiration. Time is not always in your favor when trading options—understanding theta allows you to navigate that risk with greater effectiveness.

Lastly, Rho provides the insight needed for interest rate fluctuations and their impact on options pricing. This aspect is not that well known but is very important to consider when it comes to long-term trades.

How the Greeks Affect Option Pricing and Behavior

The Greeks are important in the determination of price and behavior of stock options. Each Greek represents a different risk factor that can affect an option’s movement in price.

Delta represents the expected change in the price of an option for a $1 movement in the underlying asset. This knowledge helps traders estimate potential profits or losses during market movements.

On the other hand, Gamma indicates how much Delta will change as the underlying asset changes. High Gamma means that Delta may change significantly, which in turn affects how one might trade.

Vega is closely related to volatility, measuring the sensitivity of an option’s price to changes in implied volatility. Traders often adjust their positions in response to anticipated changes in market sentiment.

Theta, on the other hand, looks at the effect of time decay, showing how much an option loses value as it approaches expiration. Understanding this can help traders make timely decisions about exercising or selling their options before they lose value.

Using The Greeks to Drive Investment Decisions Intelligently.

Understanding the Greeks can fundamentally change how you engage with stock options trading. Each Greek symbolizes a distinct risk factor, offering insights that enable you to assess potential price fluctuations.

Delta reveals the extent to which an option’s price will alter with a $1 shift in the underlying asset. A high delta signifies increased sensitivity and greater potential for significant profit or loss.

Gamma indicates how fast delta might change. This helps traders predict changes in their position’s sensitivity as market conditions change.

Vega represents the sensitivity of an option to volatility. When one is expecting market fluctuations, this will help to make better decisions regarding when to initiate or close trades.

Theta measures time decay, showing just how much value an option loses every day as expiration draws closer. This is especially important for long positions, as knowing theta can help with the timing of trades.

Rho enables traders to view interest rate effects on options pricing and may have an effect on investment decisions where positions are held for extended periods.

Common Mistakes to Avoid When Considering the Greeks in Trading Options

The common error made by traders is neglecting the relationship among Greeks. Each Greek has some unique ways to influence option pricing, and disregarding these relationships might result in poor decisions.

Another common pitfall is to concentrate too much on one Greek while ignoring others. Focusing solely on Delta, for example, may present a distorted view of risk and reward.

Failing to adjust strategies as market conditions change can be a losing proposition. The Greeks flow and fluctuate with price and volatility; being static can result in lost potential or unexpected losses.

There are times when traders misconstrue what each Greek means in relation to their positions. It is very important to understand that Theta represents time decay, especially for options near expiration.

Finally, relying too much on theoretical models without considering real-world implications can lead to an error in judgment. Always stay grounded in practical observations when trading stock options.

Conclusion and Next Steps

Knowing how the Greeks impact trading stock options can significantly enhance your investing strategy. You learn how to interpret market movements and option pricing by knowing these key concepts.

As you navigate through stock options trading, don’t forget to include the Greeks as part of your analysis, enabling you to pinpoint precisely how changes in price, time decay, and volatility will impact your trades. You are not simply picking stocks; now you can start making the right decisions with a background of quantitative metrics.

Consider using simulation tools or paper trading to hone the application of Greek concepts without financial risk. Begin with small steps and slowly build more complex strategies as your understanding grows.

The common pitfalls of over-trading or not analyzing the data properly can be avoided by focusing on a more disciplined approach that integrates Greeks into each decision-making process.

Arming yourself with this knowledge will better prepare you for success in trading stock options. It’s a journey of continuous learning and adapting to the market conditions—stay curious and proactive in improving your strategies.